What if you had bought Apple stock in 1997?

Buying 100 shares back then was a fairly small investment that would have brought big returns.

By Kim Peterson on Fri, Oct 7, 2011 1:14 PM

Steve Jobs is clearly one of the most universally admired chief executives in history. But it wasn't always that way.

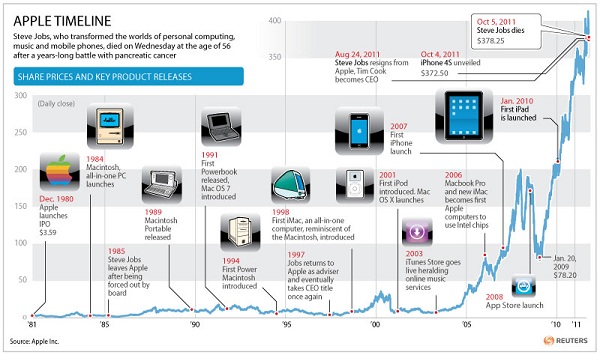

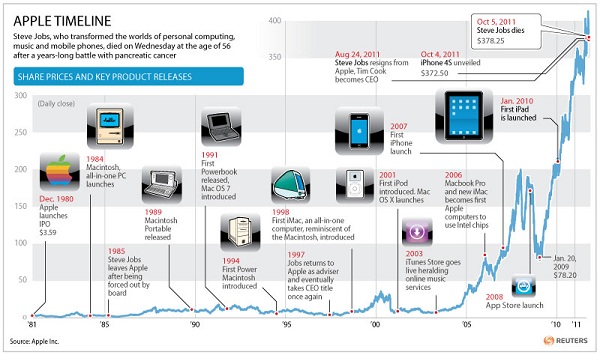

He didn't have the faith of investors back in 1997, when he returned to Apple Computer. The company was barely hanging on, and when Jobs was named interim chief executive in September, the stock price was around $21.81 (or $5.45 adjusted for splits).

What if you had believed in him back then? What if you had bought 100 shares and sold them on Aug. 24, 2011, the day Jobs resigned as CEO?

Apple (AAPL) shares gained nearly 6,700% in that time. And those 100 shares? They eventually turned into 400, and you would have come away with a cool $150,000 or so before taxes.

That investment would have required a lot of patience, however. Apple's share price stayed below a split-adjusted $8 until 2003. Then it began a slow climb until a 2-for-1 stock split in 2005. After that, the stock had more explosions than a Michael Bay movie.

That investment would have required a lot of patience, however. Apple's share price stayed below a split-adjusted $8 until 2003. Then it began a slow climb until a 2-for-1 stock split in 2005. After that, the stock had more explosions than a Michael Bay movie.

The big question, of course, is what will happen to Apple shares now. Chief executive Tim Cook, an operations whiz who has been at the company since 1998, seems to have maintained investor confidence. Shares have dipped only about 1.6% since Jobs resigned -- and that's even after this week's ho-hum debut of the iPhone 4S. Shares closed Friday down 2% to $369.80.

One of a CEO's most important duties is to build a company that performs even after his or her departure, and Jobs likely did that very well. So investors are sticking with Apple even after its tremendous loss.

He didn't have the faith of investors back in 1997, when he returned to Apple Computer. The company was barely hanging on, and when Jobs was named interim chief executive in September, the stock price was around $21.81 (or $5.45 adjusted for splits).

What if you had believed in him back then? What if you had bought 100 shares and sold them on Aug. 24, 2011, the day Jobs resigned as CEO?

Apple (AAPL) shares gained nearly 6,700% in that time. And those 100 shares? They eventually turned into 400, and you would have come away with a cool $150,000 or so before taxes.

That investment would have required a lot of patience, however. Apple's share price stayed below a split-adjusted $8 until 2003. Then it began a slow climb until a 2-for-1 stock split in 2005. After that, the stock had more explosions than a Michael Bay movie.

That investment would have required a lot of patience, however. Apple's share price stayed below a split-adjusted $8 until 2003. Then it began a slow climb until a 2-for-1 stock split in 2005. After that, the stock had more explosions than a Michael Bay movie.The big question, of course, is what will happen to Apple shares now. Chief executive Tim Cook, an operations whiz who has been at the company since 1998, seems to have maintained investor confidence. Shares have dipped only about 1.6% since Jobs resigned -- and that's even after this week's ho-hum debut of the iPhone 4S. Shares closed Friday down 2% to $369.80.

One of a CEO's most important duties is to build a company that performs even after his or her departure, and Jobs likely did that very well. So investors are sticking with Apple even after its tremendous loss.

| Tags: | AAPLAppleKim Peterson |

RELATED ARTICLES

VIDEO ON MSN MONEY

Please install the latest version of the free Adobe Flash Player. Download now.

For help with Flash, see Adobe's Flash Player Support page.

For help with Flash, see Adobe's Flash Player Support page.

40Comments

- 1

- 2

4 hours ago

Very cute article.I love it ,life is boring. My boyfriend think the same with me.he is almost 10years older than me .i met him via agelesscupid dot com a nice place for se'eking age le ss love.which gives you a chance to make your life better and open opportunities for you to meet the attractive young girls and treat you like a king. U should check it out!How about buying gold or gasoline in 1997 ??

5 hours ago

8 hours ago

9 hours ago

What if you had bought Gold back in 2001-2002 for 250 an oz you would have alot more money right now and it is just going to keep going up because you know that the government is going to print print and print some more...Gold & Silver is going to be the place to be period!...well so far the wall street is not manipulating apple stock like it has been Gold & Silver the reason is; Gold & Silver are competing currencys

14 hours ago

19 hours ago

some 12 years ago someone told me to invest everything I had in Yahoo, I asked him are you sure, because it seemed like a silly investment,, BUT, I took the plunge and sank all my cash into it.

Not until a year later did I realize I had bought YooHoo, the chocolate drink,

So please buy some , ( I wanna die)

Not until a year later did I realize I had bought YooHoo, the chocolate drink,

So please buy some , ( I wanna die)

19 hours ago

what a petty article. who in this world can't say if i had done this or bought that i'd be rich.who cares. even though i did not know steve jobs but he seemed like a man of going forward for what he believed in no matter what happened. you think he did it for the money. i'd say yes and no, and there is nothing wrong with that, he had a passion for what he wanted and proffited from his passion in life. i wish i had his skills! his life was cut short sadly , but why do a stupid article about what ifs now right after the man just passed?! money means nothing in the end, and the end comes faster than you think.shame on msn and kim peterson whoever you are for publishing such dribble.

20 hours ago

20 hours ago

20 hours ago

That is a remarkable statistic. I remember seeing a documentary, if I recall correctly called "Triumph of the Nerds," done in the mid-90s, where the narrator explained that as a teenager, he'd been hired to help move Steve Job's business operation out of his garage. They offered him the alternative of being paid the minimum wage or receiving a share of stock in Apple in payment. He took the money, and his mother reminds him of his mistake every day since. He'd now be a millionaire if he'd taken the stock.

20 hours ago

21 hours ago

21 hours ago

21 hours ago

21 hours ago

22 hours ago

22 hours ago

Report

Are you sure you want to delete this comment?

DATA PROVIDERS

Copyright © 2011 Microsoft. All rights reserved.

Quotes are real-time for NASDAQ, NYSE and AMEX. See delay times for other exchanges.

Fundamental company data and historical chart data provided by Thomson Reuters (click for restrictions). Real-time quotes provided by BATS Exchange. Real-time index quotes and delayed quotes supplied by Interactive Data Real-Time Services. Fund summary, fund performance and dividend data provided by Morningstar Inc. Analyst recommendations provided by Zacks Investment Research. StockScouter data provided by Gradient Analytics. IPO data provided by Hoover's Inc. Index membership data provided by SIX Telekurs.

Japanese stock price data provided by Nomura Research Institute Ltd.; quotes delayed 20 minutes. Canadian fund data provided by CANNEX Financial Exchanges Ltd.

Quotes are real-time for NASDAQ, NYSE and AMEX. See delay times for other exchanges.

Fundamental company data and historical chart data provided by Thomson Reuters (click for restrictions). Real-time quotes provided by BATS Exchange. Real-time index quotes and delayed quotes supplied by Interactive Data Real-Time Services. Fund summary, fund performance and dividend data provided by Morningstar Inc. Analyst recommendations provided by Zacks Investment Research. StockScouter data provided by Gradient Analytics. IPO data provided by Hoover's Inc. Index membership data provided by SIX Telekurs.

Japanese stock price data provided by Nomura Research Institute Ltd.; quotes delayed 20 minutes. Canadian fund data provided by CANNEX Financial Exchanges Ltd.

MARKET UPDATE

| NAME | LAST | CHANGE | % CHANGE | |

|---|---|---|---|---|

| # | DOW | 11,103.12 | -20.21 | -0.18 |

| # | NASDAQ | 2,479.35 | -27.47 | -1.10 |

| # | S&P | 1,155.46 | -9.51 | -0.82 |

| # | Russell 2000 | 656.21 | 0.00 | 0.00 |

| # | 10 Yr Note | 100.41 | -0.78 | -0.77 |

[BRIEFING.COM] Failure to sustain a rebound from midday losses left stocks to roll into the red during the final hour. They still made it out with week 2% higher than where they started.

The major equity averages lacked direction this morning, even though premarket participants had cheered the September jobs report. Nonfarm payrolls grew by 103,000, up from an upwardly revised 57,000 in August. However, the upside surprise is mostly due to the end of a strike at Verizon. Excluding ... More

The major equity averages lacked direction this morning, even though premarket participants had cheered the September jobs report. Nonfarm payrolls grew by 103,000, up from an upwardly revised 57,000 in August. However, the upside surprise is mostly due to the end of a strike at Verizon. Excluding ... More

More Market News

Currencies

| NAME | LAST | CHANGE | % CHANGE |

|---|---|---|---|

| Euro/Dollar | 1.33815 | -0.00521 | -0.39 |

| Pound/Dollar | 1.55642 | +0.01226 | +0.79 |

| Dollar/Yen | 76.86395 | +0.17395 | +0.23 |

Sponsored by:

- RECENT QUOTES

- WATCHLIST

RECENT QUOTES

After you search for quotes in the Get Quote box at the top of the page, they will appear here.

Sponsored by:

- RECENT ARTICLES

- JIM JUBAK

No comments:

Post a Comment